Searching for the nearest title loan is likely your top priority if you need fast cash and have a car title in your name. When you are ready to apply for a title loan, you may be required to bring your vehicle to a brick-and-mortar location for an inspection because the collateral must be examined to determine its value and overall condition. But did you know that there are title loans that don’t require you to show the car in person?

With ChoiceCash title loans, you can apply for the money you need without the inconvenience of bringing your car to a loan store for inspection. The application process is simple and convenient, allowing you to apply and get approved for a title loan without ever leaving your home! Keep reading to learn how you can get a title loan without showing the car in person, the benefits of online title loans, and the process to submit an application.1

How Can You Get a Title Loan Without Showing The Car?

Depending on the lender you choose to work with, you will be asked to drive your car to a specific location and have it inspected during the application process. However, there are alternative methods for verifying your vehicle’s value that do not involve physically showing it.

One method that some lenders use to evaluate the condition and value of a vehicle involves combining online vehicle appraisal tools or databases and virtual examinations. Based on the information you provided about your vehicle, such as its make, model, and trim level, appraisal tools can offer an estimated value of your car or truck. Other title lenders prefer to use those tools and still require the applicant to undergo a physical inspection of the vehicle to determine its resale value. The value of your vehicle and your income will primarily determine your total loan amount, so an examination – whether virtual or physical – is an important part of the application process.1 Providing accurate information about your vehicle is crucial to ensure a fair evaluation when applying for a title loan without showing the car in person. In addition to providing details about your vehicle, you will be asked to submit specific documents to verify your income and other pertinent information during your application. This typically includes a valid, government-issued ID, proof of income and residence, and a vehicle title in your name. In order to complete a virtual inspection, you will need to submit recent photographs of your vehicle during this step as well. You may need to provide additional documentation depending on your state of residence, which is why it is important to check with the lender beforehand to ensure you have all the necessary documents to proceed with your application.1

Benefits of Online Title Loans That Don’t Require Showing the Car

When it comes to getting a title loan, convenience and speed are essential pieces of the puzzle. ChoiceCash online title loans don’t require showing the car in person, so you can enjoy a hassle-free application process from the comfort of your home.1

Instead of getting in your car and going to a store, you can apply for a loan online without any hassle. No more waiting in line or rearranging your schedule to apply for the financial help you need! With just a few clicks, you can fill out the application form and conveniently submit your documents and vehicle photos online, saving you time, gas, and effort! When applying for a ChoiceCash title loan serviced by LoanMart, you also have the option to send everything through email or text message to a title loan representative.1

One of the most significant advantages of online title loans that don’t require showing the car is the absence of a physical inspection or store visit. With online title loans, this step is eliminated, making the application process faster and more convenient.1

Understanding the Process to Get a Car Title Loan Without Showing the Vehicle

Do you need quick cash but don’t want to part with your car? You can unlock cash with your car’s title and keep driving your vehicle during the repayment process! Here’s a step-by-step guide on how you can apply for a ChoiceCash car title loan without showing the vehicle in person:1

Step 1: Meet the Requirements and Fill Out a Loan Application

In order to get approved for a car title loan, you will need to have a title to a qualifying car or truck in your name, be able to provide proof of your ability to repay the loan and be of legal age. Call 855-422-7402 or conveniently complete a questionnaire for a ChoiceCash title loan on the secure website. Find out if you qualify for instant pre-approval today!1

Step 2: Provide Your Paperwork and Complete a Virtual Inspection

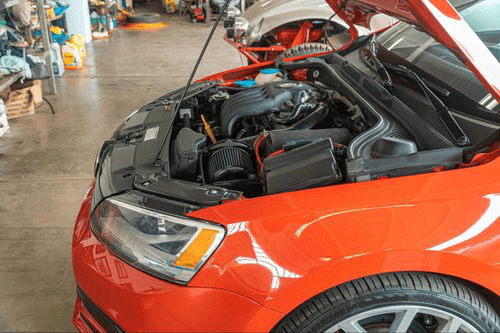

If you are prequalified, you will be asked to provide the necessary documents to verify your income, identity, and other pertinent information. Completing a virtual vehicle inspection involves submitting recent photographs of your vehicle. This includes the interior and exterior of the vehicle, along with the VIN and odometer reading. Like your documents, you can submit your pictures online or choose to send them through email or text message.1

Step 3: Approval and Disbursement Process

Upon final approval, you can choose how to receive your loan proceeds and sign your electronic loan agreement! If you decide to obtain your funds via direct deposit or have your funds added to a debit card, you can access your money in as little as 24 hours.1

Valid Reasons to Not Show the Car for a Title Loan

Everyone’s financial situation is unique, and there are valid reasons why you may not want to show the car for a title loan, including the following:

- Privacy Concerns: Some individuals may have privacy concerns about bringing their car to a loan store they’ve never been to before.

- Time Constraints: Between work, childcare, and other responsibilities, you may not have the time to drive anywhere to complete a physical car examination.

Life can be unpredictable and hectic, but that’s why it’s more convenient to apply for title loans that don’t require you to physically bring in your car for inspection. Call 855-422-7402 today to learn more about applying for flexible title loan options!1

No Inspection Title Loans FAQ

What are the Benefits of a Title Loan That Doesn’t Require Showing The Car?

Besides the ability to skip a physical car inspection, you can access a multitude of benefits when qualifying for a ChoiceCash title loan serviced by LoanMart. This includes competitive interest rates, quick cash in as little as 24 hours, and no balloon payments.1

Are There Any Hidden Fees That Come With Title Loans That Don’t Require the Car?

Not only can you avoid balloon payments at the end of your loan term, but with a ChoiceCash car title loan serviced by LoanMart, you will not have to worry about prepayment penalties or hidden fees. Instead, you can take advantage of a flexible application process and focus on what matters most – getting your finances back on track. Call 855-422-7402 to find out if title loans are allowed in your state today!1

How Do I Choose a Reputable Title Lender For a Loan Without Giving Up My Car?

With so many options, it can be tough to choose a title lender when you need emergency cash. You can use websites such as Trustpilot to evaluate the experiences that customers have with a specific company. Reading these reviews allows you to make an informed decision before choosing a lender specializing in title loans with no physical vehicle inspections.