How Do Registration Loans Work?

Registration loans are secured loans available in the state of Arizona. Through a registration loan, a qualified borrower can use their vehicle’s registration as collateral for the loan. Secured loans, such as registration loans or title loans, can be a convenient option for individuals who may not have a perfect credit score and need quick access to cash.1

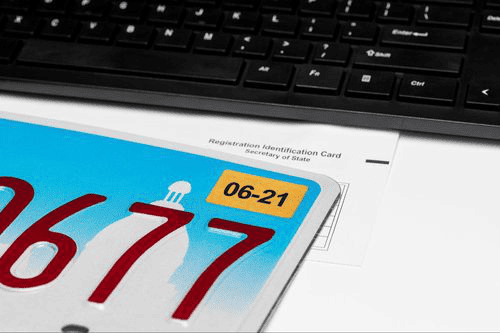

To be eligible for a registration loan, you must meet a few requirements, which include having valid vehicle registration and a qualifying car or truck. Additionally, you need to be at least 18 years old and have a steady source of income to apply for an online registration loan. Lenders will largely consider your vehicle’s value and its overall condition when determining your eligibility for a registration loan.

What is Required for a Registration Loan?

If you are thinking about applying for a registration loan, you will need to meet the requirements listed above and submit a few documents to verify your information and other important details. Typically, you can expect to need the following paperwork to get approved for a registration loan:

- A Valid Driver’s License or Another Government-Issued Photo ID

- Proof of Vehicle Registration in Your Name

- Bank Statements, Pay Stubs, or Another Document to Prove Your Income

- Proof of Address Through Recent Utility Bills or Credit Card Statements

It’s important to understand that the specific documentation needed to get approved for an online registration loan may vary depending on the lender you decide to work with. Having these documents readily available when applying for a registration loan is recommended to expedite the loan process.

How Much Can I Get for a Registration Loan Near Me?

Registration loans can provide you with the financial assistance you need when your finances are rocky. Generally, the amount you can obtain through a registration loan will be based on:

- Your Income

- The Value of Your Car

- Your Ability To Repay The Loan

The registration loan lender will assess your car’s make, model, year, mileage, and overall condition to determine its market value. To calculate the loan amount based on the value of your vehicle, lenders typically use a percentage of the car’s appraised value. This percentage can range from 25% to 50% of the vehicle’s value.

The higher the value of your vehicle, the more you may be eligible to borrow if you have the ability to pay it back. Remember that the lender you choose to work with may impose maximum loan limits for registration loans, which can affect the amount you are eligible to borrow.

Ultimately, registration loans are meant to be short-term solutions to financial issues. Before applying for a registration loan, carefully assess your financial situation to ensure that you can realistically repay the loan. Car registration loans usually come with high interest rates and a very short window to pay off your loan. Failure to meet this tight deadline could result in additional fees, increasing your debt and complicating the repayment process. In some cases, a registration loan lender could send your debt to a collection agency if you default on your loan.

Registration Loans vs. Car Title Loans

Registration loans and car title loans are two common options for individuals with bad credit scores who need fast cash. While they may seem similar, it’s important to understand the key differences between them in order to make an informed decision.

Car registration loans and auto title loans can cater to individuals with bad credit, allowing them to borrow money against their vehicles. Since both loans are secured by collateral, the approval process is much more flexible for borrowers who need emergency cash. Both car registration loans and title loans can be convenient and simple to apply for, which can be a huge advantage during a financial crisis.

There are a few key differences between the two loan options. With a car title loan and a registration loan, you are able to apply for funding even if you are still financing your vehicle. However, with a car title loan, if you are approved and sign your contract, the title lender will directly pay off your existing auto loan. Then, your obligation is to keep up with your title loan payments. You may also apply for a car registration loan if you are still paying off your car. But if you are approved, you will take on an additional loan. The registration loan lender does NOT pay off your auto loan, so you are responsible for repaying both loans simultaneously. Additionally, registration loans are only available in the state of Arizona. In comparison, title loans are available in many states.

While vehicle registration loans can provide some temporary financial relief, they can be financially detrimental in the long run. Payday loans aren’t available in the state of Arizona, but registration loans are. Some registration loan lenders are known to use the same tactics payday lenders use to trap customers in a cycle of debt. Car registration loans may provide quick funding that can cover an unexpected bill or expense, but they may not be worth the headache they can cause borrowers. Although they allow customers with bad credit to apply for fast cash to handle a variety of financial issues, many more advantageous loan options can be available to qualified borrowers without a strong credit history!

When choosing the right loan option, it’s essential to consider your financial needs and your current situation. A car title loan might be a more suitable choice if you need a larger loan amount and have a vehicle title in your name. On the other hand, if you only need a smaller loan amount and prefer to keep your vehicle’s title, a registration loan may be a better fit. Ultimately, the choice is yours to make.

Car title loans can be a convenient way to deal with your financial troubles and avoid the headaches associated with registration loans. Submit a prequalification form online or dial 855-422-7402 to apply for a ChoiceCash title loan today!1