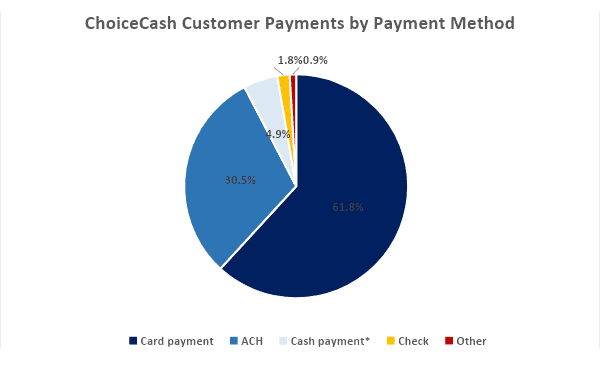

Distribution of ChoiceCash Customer Payments by Payment Method

As one of the premier title loan options in the United States, ChoiceCash takes pride in providing flexible repayment terms and several convenient payment methods.

An analysis of customer payments made between January 2024 and August 2024 reveals that ChoiceCash customers take advantage of the multitude of available payment options, while exhibiting a strong preference for electronic payment methods.

In the first 8 months of the year, 61.8% of ChoiceCash customer payments were made by card, followed by 30.5% of payments made by bank ACH. 4.9% of payments were made at participating, licensed money transfer locations, whereas only 1.8% of payments were made by personal check. The remaining 0.9% of payments were made using other, less common payment methods including mailing a money order or cashier’s check to the payment processing center.

Electronic payments via card or bank account combined accounted for 92.3% of payments, demonstrating that ChoiceCash online title loan customers prefer the convenience without having to leave their home.

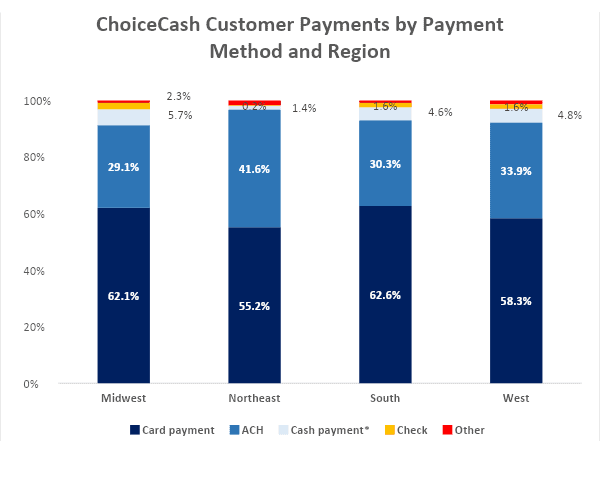

Distribution of ChoiceCash Customer Payments by Payment Method and Census Region

A breakdown of the customer payments by US Census Region shows some regional differences in customer preferences for certain payment channels. ChoiceCash customers in the Northeast had the highest propensity to make payments electronically, with 96.7% of payments being made via ACH or card.

Conversely, at 91.2%, customers in the Midwest exhibited the lowest propensity to make payments via electronic payment methods, while showing the highest preference for both check payments and cash payments made at participating money transfer locations, with 2.3% and 5.7% of payments respectively.

The South and West regions are virtually tied with respect to payments made via money transfer locations, at 4.6% and 4.8% respectively, as is their residents’ preference for electronic payments, with a combined share of 92.9% and 92.2% respectively for card and ACH payments combined.

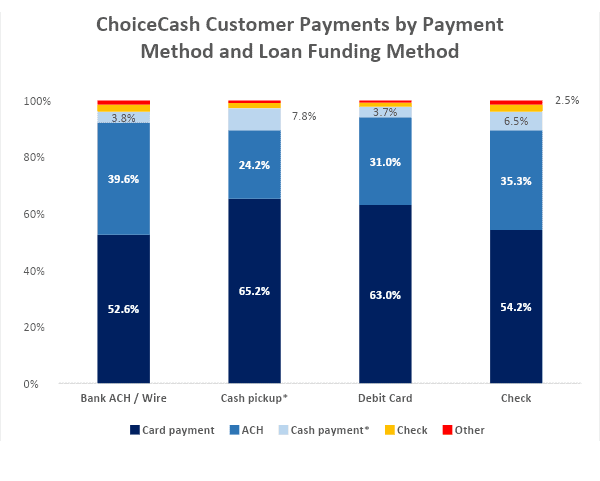

Distribution of ChoiceCash Customer Payments based on Loan Funding Method

The distribution of ChoiceCash customer payments grouped by how the loan proceeds were disbursed to the customer at the inception of the loan shows that ChoiceCash customers’ funding preferences also reflect in their payment preferences. For instance, ChoiceCash customers who received their loan proceeds via cash pickup at a money transfer location used cash payments at money transfer locations most extensively, with 7.8% of payments made that way.

Albeit small, ChoiceCash customers who received their loan proceeds via check also had the highest percentage of payments made via check, at 2.5% of payments.

ChoiceCash customers who were funded via bank ACH or wire transfer were the heaviest users of bank ACH as a payment channel, with almost 40% of payments made via ACH.

In summary, ChoiceCash’s ability to provide multiple convenient ways for customers to receive their loan proceeds and make their payments allows title loan customers to transact with ChoiceCash in alignment with their preferences.

* Cash payment and Cash pickup refer to payments made at participating money transfer locations, and loan disbursements picked up by customers at participating money transfer locations.

Contact: media@choicecash.com