Online Title Loans Made Easy

Financial emergencies can happen to any of us. Maybe a family member needs some unexpected medical help, or perhaps you need to repair your home after a bad storm. Whatever the circumstances are, they always tend to require extra money.1

Not everyone has access to funding for things that pop up. If you’re struggling financially or have a bad credit history, consider applying for a ChoiceCash title loan serviced by LoanMart! Upon approval, you can be eligible for same day cash using your vehicle as collateral.1

ChoiceCash makes it easy to get the money you need when you’re in a difficult situation.1 You can complete almost the entire process online from the comfort of your own home.

Meet Some of Our Happy Customers!

See some of our verified reviews from customers in more than 20 states

3 Easy Steps to Get Your Cash

With ChoiceCash, you can get the funds you need in these 3 easy steps:

Call or Apply Online1

Apply online 24/7 or call one of our friendly loans officers during regular business hours.

Submit Documents

Submit the required documents for quick verification. We keep the required documents to a minimum to ensure the ChoiceCash process is easy and convenient.

Sign Agreement and Get Your Cash

Once your documents are verified and you’ve signed your loan agreement, you may get your funds as fast as same-day.1

Why ChoiceCash?

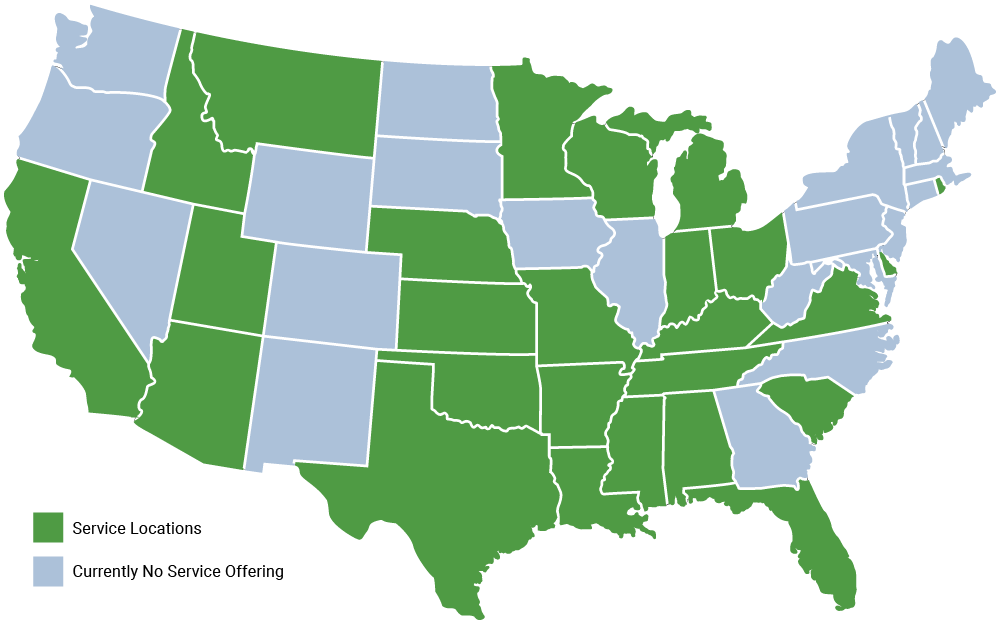

Since 2019, ChoiceCash has been serving customers in more than 20 states, and we continue to expand. Every year we help thousands of customers get the cash they need fast, when they need it the most.

With ChoiceCash, you can expect to:

Get Cash Your Way

- Apply online and choose how you get your loan proceeds

- Borrow as little or as much as you want, within your approved loan amount range

- No bank account required to get funded or to make payments

Relax with low payments

- Manageable monthly payments with your budget in mind

- Your payment and interest rate may reduce every month²

- No hidden fees or balloon payment at the end of your loan

Enjoy flexibility and convenience

- Freedom to repay at any time, with no pre-payments penalties

- Multiple ways to conveniently make a payment

- Manage your loan account online 24/7

While other title loan companies might require that customers visit a title loan store for a vehicle inspection, ChoiceCash was designed with online convenience in mind. With ChoiceCash, no store visit or physical car inspection is required. Thanks to a streamlined loan process, customers can get the cash they need as fast as same-day.1 If you are looking for the best online title loan, give ChoiceCash a try.

Where you need it, when you need it

Title Loan Services Near Your Home

Frequently Asked Questions

How much can I borrow with ChoiceCash?

In most states, ChoiceCash has a maximum loan amount of $15,000. The maximum that a particular applicant may get approved for largely depends on the value of the vehicle and the applicant’s income.1

How can I qualify for a ChoiceCash loan?

In order to potentially qualify for a ChoiceCash title loan, applicants need to reside in a state serviced by ChoiceCash, own a car or truck that can be used as collateral for the loan, and have verifiable income to make the monthly loan payments.1 Approved applicants will need to submit some documents that can slightly differ by state – they generally include vehicle pictures, a government-issued ID, and various options to validate the applicant’s address and income.

Can I pay off my ChoiceCash loan early?

Yes! The ChoiceCash loan can be paid off at any time, without any pre-payment penalty.

If you have other questions, please visit our FAQ page to find answers to the most common title loan questions, or Contact Us – we’re here to help!