Table of Contents

- How Do Registration Loans Work?

- How Much Money Can You Get Through Registration Loans in Arizona?

- How to Get a Registration Loan Near Me

- Can You Have More Than One Registration Loan at a Time?

- How Do Online Registration Loans Compare to Car Title Loans?

- What Happens if I Don’t Pay My Car Registration Loan?

How Do Registration Loans Work?

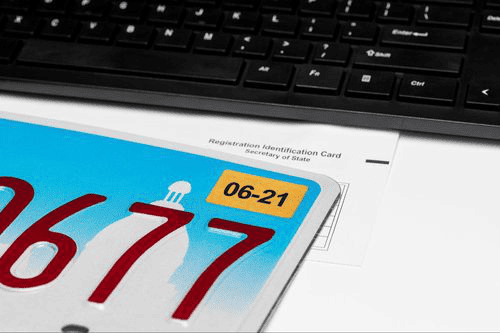

Registration loans work by allowing you to use your car’s registration as collateral for the loan. Arizona residents may turn to registration loans when they need fast funding because they are often much more flexible than traditional bank loans. You don’t need a high credit score to be eligible for a vehicle registration loan!

In order to qualify for this type of secured loan, you will need to meet the lender’s requirements and provide the right documentation. Typically, this includes being a resident of Arizona and having valid vehicle registration, along with a qualifying car or truck. You must also present proof of a steady source of income during your application, and lenders will primarily use your vehicle’s value to determine your eligibility for a registration loan.

How Much Money Can You Get Through Registration Loans in Arizona?

Registration loans can be a convenient way to access emergency funding when you need to get your finances back on track. Generally, the amount you can access by using your car’s registration as collateral for the loan will be based on:

- The Value of Your Car

- Your Ability to Repay the Registration Loan

The registration loan lender will review your car’s make, model, year, current mileage, and overall condition during your application in order to determine the market value of your vehicle. You don’t need to have a specific make or model to qualify for a car registration loan, but your car must have a qualifying amount of equity. Typically, you can access a percentage of your car’s appraised value – often around 25%-50%, depending on the lender you decide to work with.

The greater the value of your vehicle, the more you can potentially access through this secured loan option as long as you can provide proof of your ability to pay the loan back. Keep in mind that some lenders have maximum loan limits for registration loans. Your lender’s maximum loan-to-value ratio will impact the amount you can borrow if you choose to apply for an auto registration loan.

How to Get a Registration Loan Near Me

You will only be able to apply for a registration loan if you are a resident of Arizona and find a lender who is willing to offer this type of secured loan. If you have located a lender, your first step will be to submit an application online, over the phone, or in person at a storefront location.

If you are initially approved, you must provide the documentation mentioned above, along with proof of residence and any other documents that your lender requires you to submit during this step. Generally, you will need to have a valid, Arizona-issued identification card and proof of car insurance at the time of your application. Some lenders may request that you complete a physical vehicle inspection during the underwriting process for a registration loan.

Before you sign your agreement, make sure to fully review the terms and conditions of the registration loan. Take a closer look at what the repayment process will look like and determine whether you can afford to pay the loan back in that timeline. Registration loans tend to saddle you with high interest rates, and you will typically only have a short window to repay your loan. Failure to meet this tight deadline can result in additional fees and more financial stress, so it is important to compare all of your options before you sign on the dotted line.

Can You Have More Than One Registration Loan at a Time?

It is possible to have more than one registration loan at a time, but it may not be the smartest decision to take out multiple loans at once. Before you submit an application for multiple registration loans, sit down and go over your current budget. Take a look at your income along with your current monthly expenses (including your current debt obligations) and determine whether or not you can realistically handle paying back multiple loans simultaneously.

How Do Online Registration Loans Compare to Car Title Loans?

Both car title loans and registration loans allow you to keep your keys and continue driving your car throughout the repayment process. Maintaining access to your vehicle while paying back your title loan or registration loan can be a huge advantage for borrowers who need emergency funding and rely on their cars to get to work every day.

Car title loans and registration loans are secured loans that share similarities, but there are some key differences between them. With a car title loan and a registration loan, you are allowed to apply for funding even if you are still financing your vehicle. The main difference between car title loans and registration loans is that if you qualify for a title loan while still making payments on your car, the title lender will directly pay off the existing car loan. After your car loan is paid off, your obligation is only to pay for your car title loan. With registration loans, the lender has no obligation to pay off your existing auto loan, so you are responsible for paying both loans simultaneously.

Payday loans are not available to residents of Arizona, but registration loans can be a common loan option for people living in the Grand Canyon State. In fact, only Arizona residents are allowed to apply for online registration loans! If you live outside of Arizona and you need emergency cash, you will need to look for other financing options, such as title loans.

If you are eligible for a ChoiceCash title loan serviced by LoanMart, you can expect to experience perks like competitive interest rates, flexible loan terms, and cash in as little as 24 hours! Check out our location page to see if title loans are available in your state today. You can fill out an online prequalification form 24/7 and instantly see if you are initially approved for emergency funding.1

What Happens if I Don’t Pay My Car Registration Loan?

Your financial situation can change during the repayment process for a car registration loan. Maybe you lost your job, or a visit to the vet wiped out your savings and checking account. If you can’t make a payment on your loan on the due date, it’s best to notify your lender in advance. Failure to repay your registration loan may not result in the repossession of your vehicle right away, but your lender may sell your debt to a third party in an attempt to recover the amount you still owe.

Whether you choose to apply for a title loan or a registration loan, it is important to keep up with your payments and discuss your options with your lender or loan servicer if you are struggling with your finances during the repayment process.

Registration loans can be a fast way to access financial relief, but they may not be worth the headache they can cause some borrowers. Even if you have bad credit, a car title loan can be a more suitable choice if you have a vehicle title in your name and you want to avoid the hassles that may come with repaying for a registration loan!