Table of Contents

- What Are Title Loans and How Do They Work?

- How Does a Car’s Mileage Affect Title Loans?

- What Constitutes High Mileage in Vehicles?

- How Does Choicecash Determine a Vehicle’s Value?

- Can I Get a Choicecash Loan With a High-mileage Car?

- Eligibility Criteria for Choicecash Title Loans on High-mileage Vehicles

- What Kind of Documentation Is Needed for High-mileage Title Loans?

- What Is the Process for Getting High-mileage Title Loans?

- Tips for Managing Your Title Loan for a High-mileage Car

Say you need cash fast for a security deposit, a medical bill or another unexpected expense. The problem is, you lack the credit for a bank loan, which could take too long to get anyway. You’ve heard about title loans and how you don’t need good credit to get one.1 You’ve got the main requirements covered: a car in your name and a steady income. What concerns you though is your vehicle has high miles. Would that prevent you from securing an auto equity loan? Not necessarily. Here’s what you should know about getting title loans with high mileage.

What Are Title Loans and How Do They Work?

An auto equity loan uses your vehicle – registered in your name – as collateral. The lender places a lien on your car’s title when you accept the funds and removes it once you pay your loan off. To qualify, you generally need to own a vehicle with sufficient value, and have a steady income.1 The lender secures your loan with your vehicle’s title, enabling fast funding for those who need it. If you don’t have your title document in hand, you can get a copy at the Department of Motor Vehicles or equivalent.

A significant benefit of car title loans is that you can retain full ownership of your vehicle throughout the loan term and continue driving it.1 However, it is important to understand that if you miss payments, the lender has the right to sell your car to recover the remaining balance. This is why it is important to make sure you can manage the loan responsibly before proceeding.

How Does a Car’s Mileage Affect Title Loans?

When you apply for a car equity loan, your car’s value and your income are the main factors that determine eligibility.1 To receive cash using your car title, the vehicle must have sufficient value for the lender to feel confident using it as collateral. Generally, the higher your car’s value, the greater your loan amount can potentially be. Meanwhile, the higher the vehicle’s mileage, the lower its value tends to be. With a low vehicle value, it can be more difficult to qualify for a vehicle-secured loan, or to qualify for large loan amounts.1

What Constitutes High Mileage in Vehicles?

With today’s technological advances, there is no hard-and-fast rule for what “high mileage” means, although vehicles with between 150,000 and 200,000 miles often fall into that category. Mileage policies vary among lenders. There’s also the matter of context: while some may consider a five-year-old vehicle with 150,000 miles as high mileage, they may not think the same of a 10-year-old car with the same mileage. In the U.S., most motorists drive an average of 12,000 to 15,000 miles annually. Also note that some brands, such as Honda and Toyota, are known for their longevity and may remain reliable well beyond 200,000 miles. Additionally, vehicles considered classics may be worth more than some newer vehicles – regardless of their mileage.

How Does Choicecash Determine a Vehicle’s Value?

You pledge your vehicle as collateral for your ChoiceCash auto title loan, and it plays a significant role in how much you can borrow. We base your potential loan on the equity in your vehicle, and mileage is a key consideration, along with the make, model, year, and overall condition.1 You can get some idea of your vehicle’s worth by consulting reputable sources such as Kelley Blue Book or Edmunds, or by using the ChoiceCash application.

Can I Get a Choicecash Loan With a High-mileage Car?

You may be able to borrow against a high-mileage vehicle if it has enough value, and you have sufficient income.1 Since higher mileage typically – but not always – lowers a car’s market value, older or high-mileage vehicles often qualify for smaller loans. Additionally, high mileage can indicate the car may have a shorter remaining lifespan. So ultimately, yes you may be able to apply and qualify for a ChoiceCash loan with a high mileage car, as long as it meets the applicable minimum vehicle value in your state.

Eligibility Criteria for Choicecash Title Loans on High-mileage Vehicles

Borrowers seeking high-mileage auto title loans must also meet the ChoiceCash eligibility requirements. You must own the high-mileage vehicle you are planning to use to secure your loan. The vehicle must still meet the value requirements, despite its high odometer reading. You must also have a consistent income, whether from traditional employment or alternative sources such as Social Security or retirement benefits.1 However, you don’t always need good credit. While a hard credit inquiry is required to complete a full credit review, a prior bankruptcy or credit card charge-off does not automatically disqualify a customer from applying for or potentially qualifying for a ChoiceCash Loan.

What Kind of Documentation Is Needed for High-mileage Title Loans?

Forget dealing with mounds of paperwork. We keep the required documentation to a minimum at ChoiceCash. Our goal is to help get you the funds you need as quickly as possible. With that in mind, the following is all you need to provide upon approval:1

- Valid government-issued photo identification, such as a driver’s license or passport

- Proof of address (for example, a credit card statement or current utility bill)

- The vehicle title in your name

- Proof of income, such as pay stubs or bank statements

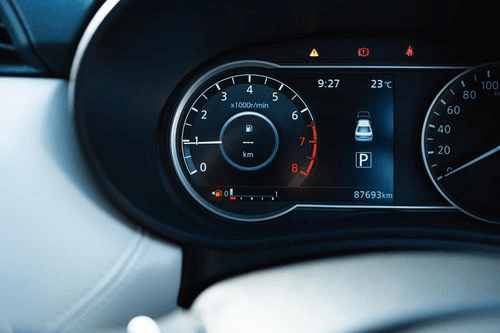

- Clear photos of your car’s exterior, interior, vehicle identification number, and odometer.

- In some cases, you may also need to supply a DMV document granting us permission to place the lien

What Is the Process for Getting High-mileage Title Loans?

The process for obtaining a high-mileage auto title loan is essentially the same as for a standard vehicle-secured loan. All you need to do is:

- Submit a brief online application, or call 855-422-7402 to apply by phone1

- Supply the necessary documents if pre-qualified

- Upon final approval, review and sign the loan agreement and deliver your title

- Receive or pick up the funds

Once you accept the loan funds, the lender will place a lien on your car’s title. With ChoiceCash, loan approval can take under an hour, and your cash may be available as quickly as the next day – potentially even sooner.1

Tips for Managing Your Title Loan for a High-mileage Car

If you have a vehicle with many miles, your primary concern may be qualifying for the funds you need. Here are a few tips to help you make smart financial decisions beyond the loan application.

- Compare lenders for the best high-mileage loan option. As mentioned earlier, lending criteria can vary significantly among lenders, including maximum odometer limits. Don’t forget to check the lender’s reputation online.

- Keep your car in good condition. While maintaining your high-mileage vehicle is essential for loan approval, it’s just as important to keep it running smoothly afterward. If your car breaks down during your loan term, you’re still responsible for paying the loan.

- Pay attention to the loan term. High-mileage vehicles often require more upkeep and costly repairs are more likely over time. If your title loan has a long repayment period, keep these potential expenses in mind.

- Borrow only what you need. While we may approve you for more than you expect on your high-mileage vehicle, it’s wise to borrow only what you need.1

Many different vehicles can qualify for a title-secured loan, including older, high-mileage models. As long as your car has enough value to secure the loan, you can still be eligible for ChoiceCash funds. In other words, the mileage on your car may not be as big of a concern as you may think! Apply for your ChoiceCash loan today!1