Life doesn’t always go according to plan. One moment you might feel financially secure, and the next you’re faced with an unexpected medical bill or the stress of making rent. In times like these, having quick access to funds can be crucial. But for many people without savings or a reliable safety net, this can be a real challenge. If you’re experiencing financial difficulties and your credit isn’t where you’d like it to be, a ChoiceCash car title loan in Lehi, Utah may be a solution worth considering.

Understanding Title Loans in Lehi, UT

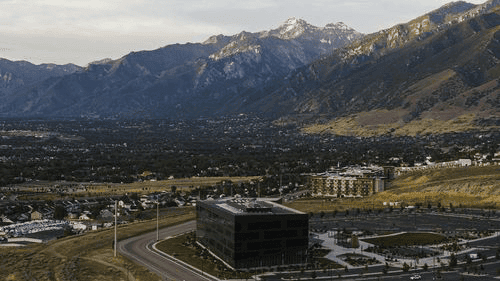

Lehi is among Utah’s more expensive cities, which could make it difficult for some residents to deal with unplanned expenses. That’s where a ChoiceCash title loan can make a difference. Since 2019, we’ve been providing quick access with flexible installment loans designed to meet any personal or household need.1

For Lehi residents who struggle with credit issues or lack access to traditional bank products, these loans can offer a practical and accessible financial solution.

How Title Loans Work in Lehi

To be eligible for a ChoiceCash title-secured loan in Lehi, applicants must provide proof of a stable income source and own a qualifying vehicle registered in their name.1

A ChoiceCash title loan allows the borrower to use their fully or nearly paid-off vehicle as collateral. When issuing the loan, the lender places a lien on the car’s title and removes it once the loan is fully repaid.

Note that although ChoiceCash reviews credit reports, greater emphasis is placed on the applicant’s income and ability to repay the loan.1 Loan approval can be completed in under an hour, with funds potentially available as soon as the next business day – or even earlier.1

Once ChoiceCash approves you for a title loan, you can continue driving your vehicle as usual while you make your payments on time. Plus, there’s no need for an in-person vehicle inspection.

In addition, you have several options for receiving your ChoiceCash loan funds and making monthly payments, and none of them require a bank account.

And with our loans, you won’t encounter hidden fees or out-of-the-blue balloon payments. Further, your interest rate could even drop over time, meaning your monthly payments might shrink, leaving more cash in your pocket.2

Keep in mind that falling behind on payments could result in the lender repossessing your vehicle. Before committing, make sure you’re confident in your ability to repay the loan.

The Benefits of Choosing Choicecash Title Loans for Quick Cash in Lehi

Choosing a ChoiceCash title loan can come with with several advantages, including:

- Your monthly payment could decrease over time. As your loan term progresses, the interest rate may go down, which can lower your monthly payment. This reduction can occur monthly through the end of your loan term as long as your account remains in good standing.2

- You can continue driving your car while making regular loan payments. As long as you stay current on your payments throughout the loan term, you retain full use of your vehicle.

- You may still qualify for a ChoiceCash loan with bad credit or marred credit history. While we do check your credit, our main focus is on your ability to repay the loan – not your credit score or past financial issues.1

- Transparent terms. We at ChoiceCash pride ourselves on offering clear, straightforward terms. You can feel confident knowing there won’t be any surprises.

Why Choose Choicecash for Title Loans in Lehi, UT?

Check out these ChoiceCash title loan features:

- Competitive interest rates. ChoiceCash car equity loan borrowers can expect competitive interest rates, especially when compared to alternatives like payday loans which are often available to those with subpar credit.

- Flexible repayment options. There are several ways to repay your loan, and no bank account is required.

- Fast and easy application process. Completing your online loan application could take as little as five minutes, and approval might happen in under an hour. Once approved, you could have cash in hand within a day – or possibly sooner.

- Exceptional customer service and support. Whether you live in Lehi or the nearby cities of Orem, Provo, or Salt Lake City, you can expect excellent customer service and dedicated support every step of the way.

Requirements for Choicecash Title Loans in Lehi, UT

What Are the Required Documents to Qualify for a Lehi Title Loan?

ChoiceCash makes it easy – less paperwork means faster access to your cash. All you need is:

- A valid ID (for example, a driver’s license or passport)

- Proof of your Lehi residence (such as a signed lease agreement, credit card statements, or utility bills)

- Proof of consistent income (including alternative sources such as Social Security and retirement benefits)

- Clear, up-to-date photos of your vehicle inside and out

What Are the Eligibility Requirements in Lehi?

To apply for a ChoiceCash car loan, you must be a Utah resident who is at least 18 years old.

You must also have a vehicle in your name that has sufficient equity. Even if your car is nearly paid off, it may still qualify as collateral.1 Already have an auto loan with another lender? You can apply with ChoiceCash to see if you’re eligible for a lower monthly payment or interest rate.1

How Much Can I Borrow From Choicecash in Lehi?

The amount you can borrow depends on the lender, as each may set limits based on factors like your income, debt-to-income ratio, and any remaining balance on your vehicle. With ChoiceCash, you may be eligible to borrow up to half your car’s equity, with a maximum loan amount of $15,000.1

We offer the flexibility to borrow any amount – large or small – within your approved loan amount range.

What Should I Know About Vehicle Valuation and Its Impact on Loan Amounts?

Older vehicles or those with high mileage typically qualify for lower ChoiceCash loan amounts, as their market value tends to decline over time. You can use our online calculator tool for an estimate of your car’s value.

If you handle your loan responsibly and make timely payments, a title loan in Lehi can be a fast and reliable way to access the funds you need. Start your application online today!

The addresses shown below display the nearest participating MoneyGram locations in the general vicinity: